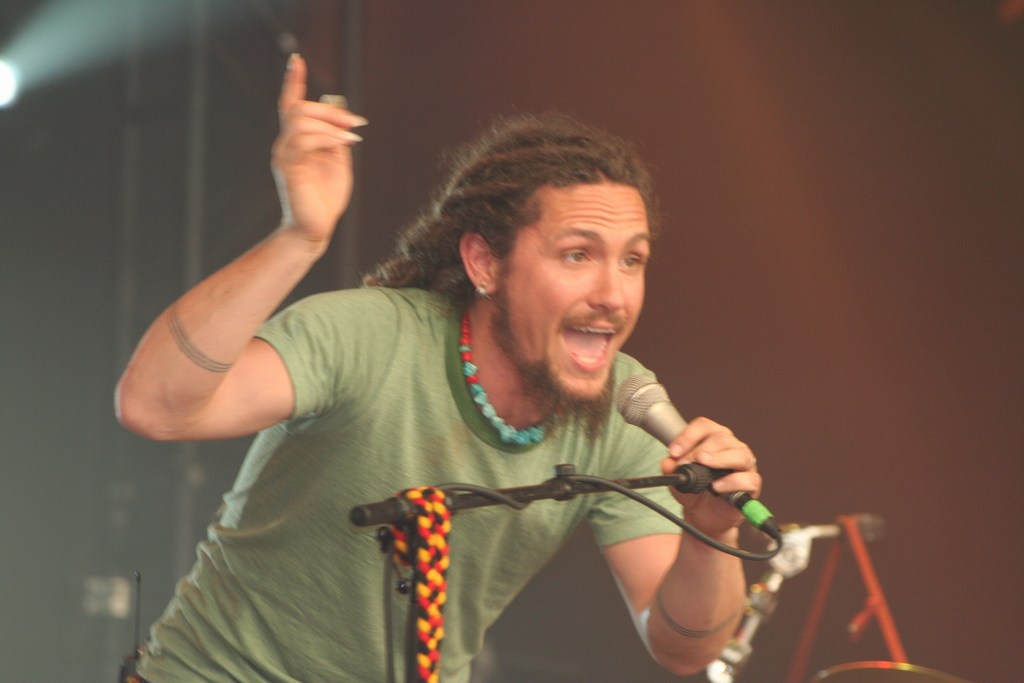

John Butler of the John Butler Trio continues his meditation on economic theory...

John Butler of the John Butler Trio continues his meditation on economic theory...Well, yes and no.

Those with only a passing acquaintance of economic theory may be surprised to know that while Milton Friedman was no fan of bail-outs, he might not be one to oppose the proposed action to save US lending institutions.

As Friedman once told the ABC:

“...at all times from 1929 and 1933, the Federal Reserve had the power and ability to have prevented the decline in the quantity of money and to have increased the quantity of money at any desired rate.

So in our opinion, the Great Depression was not a sign of the failure of monetary policy or a result of the failure of the market system as was widely interpreted. It was instead a consequence of a very serious government failure, in particular a failure in the monetary authorities to do what they'd initially been set up to do.

When the Federal Reserve Act was passed in 1913, its major purpose was to prevent 'banking panics' as they were called, temporary crises that had occurred in the United States in 1907 and during earlier periods. What it did was to preside over the worst banking panic in the history of the United States. Not only did the quantity of money go down by a third, but about a third of the banks failed and in the Spring of 1933, the Federal Reserve System, which had been set up to prevent banking panics, closed its doors itself and stopped operating.”

3 comments:

Sorry... I'm a skeptic on this one.

The same people who, three weeks ago, had no idea that this was going to happen are now parading themselves around as experts, assuring us exactly what the future holds.

We can't take them seriously. They've been falsified.

There is no guarantee the bailout will work... in fact today alone the US stockmarket lost twice as much money as the proposed bailout would have injected.

You can't unscramble an egg.

We just have to watch, wait, and deal with it.

Ha!

Nobody has responded to my comment. That means I win.

Take note, Paulson.

It's not that hard to win an argument around these parts, DD..

Post a Comment